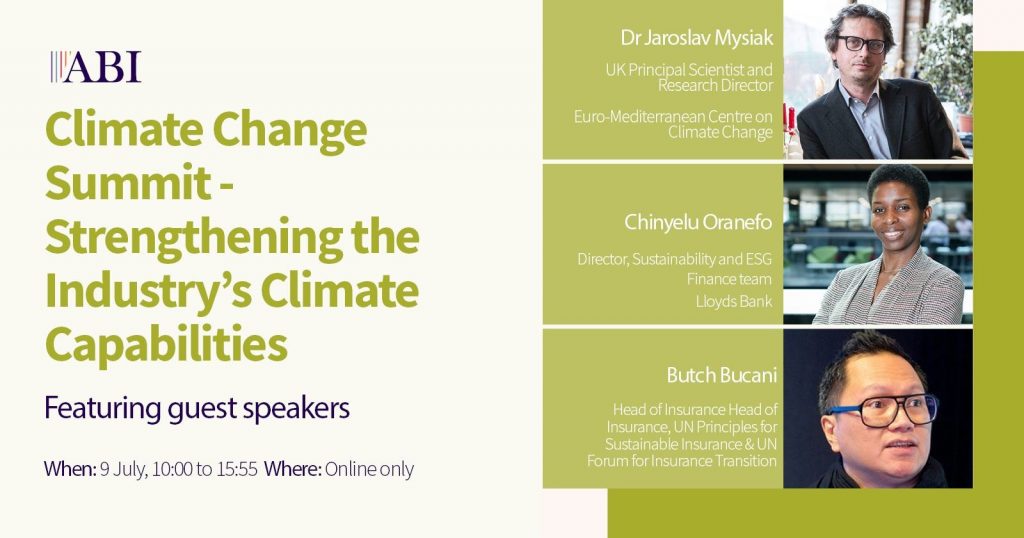

This year, the Climate Change Summit held by the Association of British Insurers (ABI) focused on strengthening the industry’s climate capabilities and was delivered as a live webinar. This one-day virtual event, held on the 9th of July, aimed to delve into practical tools and share up-to-date insight to help the sector understand its impact, manage risks and prioritize actions. During the first panel of the event, which covered nature risk and nature-based solutions, the project coordinator Jaroslav Mysiak spoke about NATURANCE and how insurers can contribute to the restoration of nature. In the same session, Charlie Dixon (Green Finance Institute) shared his in-depth knowledge of nature-related risks and their impact on the economy while Lena Fuldauer (Allianz), gave attendees examples of insurance innovation in relation to nature.

The second panel spoke about the elements and importance of credible transition plans that cover investment portfolios and under-writing with insights from Ben Caldecott (Oxford Sustainable Finance Group), councillor Irem Yerdelen (City of London Corporation), and Butch Bacani (UNEP’s Head of Insurance). The third panel discussed what measures are required to adapt to a climate-changed future. Julia King, Baroness Brown of Cambridge, explained why adaptation measures are crucial and that we’re already being affected by our lack of preparedness. Andrew Harrop followed this by sharing the Fabian Society’s analysis of why adaptation needs to start with low-income households given their increased exposure to heatwaves and flooding combined with their financial circumstances meaning they’re least resilient. Chinyelu Oranefo (Lloyds Banking Group) provided us with practical advice about how insurers can prioritise their efforts.

Deepak Jobanputra (Vitality Life) and Dan Harrowell (Thatcham Research) enlived panel four, covering innovation and collaboration across the health and motor industry to reduce scope three emissions. Caroline Dunn, (Zurich UK) talked how customer engagement led them to the decision to stop providing new insurance underwriting for oil and gas projects. The final panel of the day benefitted from the academic rigor of Nicola Ranger and JesseAbrams, who shared the increasing body of research showing that economic models underpinning climate scenario modelling in financial services do not always reflect the threat of climate change and loss of biodiversity poses to our planet and society.